SME

Banking

Platform

https://www.smeplatform.co/

What is about SME Banking Platform?

SME Stage is intended to engage miniaturized scale and private companies, business people and people in Sub-saharan Africa, with the budgetary administrations and advanced innovation they require to begin and develop their organizations.

Token Metrics

Token Name: SME Banking Platform

Token Symbol: SME

Total Token Supply: 150,000,000

Token Type: ERC-20

Token Allocation

► Add up to token supply: 150,000,000 SME

► 0.67% starting dissemination: 1,000,000 SME for Beginning Limited time Airdrop

►69% saved for token deal, organizations, advertising, onboarding introductory clients on our advanced managing an account and different administrations: 103,500,000 SME

►10.33% held to remunerate token holders/devotees to our task, circulated after some time starting after our center organizations initiate: 15,495,000 SME

►20% held for the present and future colleagues, staff and guides, discharged after some time: 30,000,000 SME

Our Market

In spite of the overflowing difficulties, the financial development in Sub-saharan Africa is consistently on the ascent. We should investigate a report from Concentrate Financial matters on the Gross domestic product development rate of Sub-saharan Africa in 2017 conversely with 2016. At the point when this development is extrapolated into the future, we grapple with the way that Sub-saharan Africa is the following major developing economy to watch. Curiously, more than 80% of the economy of Sub-saharan Africa is controlled by SMEs. Our business is to give the financing and innovation that miniaturized scale and little organizations need to succeed.

The Plan

The vision and mission of SME Managing an account Stage will be executed thusly:

1.The Microfinance Bank

This will be an authorized substance, and its business will principally include smaller scale loaning to miniaturized scale and private companies and people with demonstrated gainful limits, who have did not have the essential money to assemble and grow their little endeavors. This business line will utilize “The Gathering Loaning Structure” also called the “Grameen Display”, named after the well known Grameen Microfinance Bank of Bangladesh. Additionally, under the bank, we will have an online group subsidizing gateway where a portion of the independent companies we have appropriately reviewed for financing will be recorded. Individuals who want to help any of the independent ventures can make a commitment on the site towards that specific business. The assets come to 6 us and we send it as per our strategy for success for subsidizing organizations. The benefactors will recover their cash with a specific settled premium on regularly scheduled payment premise, until the point when the all assets are paid back with intrigue. This is another approach to grow our financing sources to empower us help more independent companies succeed.

2.Digital Bank

SME Managing an account Stage will work an advanced keeping money business. It will be to such an extent that a client can open a record with us subsequent to going through essential KYC prerequisites.

This record will have a customary record number and a digital currency wallet for our SME Token. This will empower clients spare cash, and do quick and savvy cash exchanges utilizing both fiat and cryptographic forms of money

3. The Decentralized Money Remittance Business

We will offer a decentralized cash settlement benefit which will empower clients to send and get cash all inclusive. This stage will be controlled by our local ERC-20 token, SME. This will empower the more than 30 million Africans inhabitant around world send cash in a quick and financially savvy route back home. These settlements are esteemed at over $50 Billion yearly.

4. The Micro-payments Application for Small Businesses

SME Keeping money Stage will chip away at building an online portal that is essentially suited for miniaturized scale and independent companies, empowering them with a non confused innovation to acknowledge online installments for their items and administrations. It will likewise have abilities for some fundamental bookkeeping capacities.

5. The Loyalty Rewards Network

This will associate independent ventures to the client system of greater organizations by having them share a similar steadfastness rewards arrange, with the end goal that a client who gets granted dependability rewards focuses by a business can reclaim such focuses through other organizations inside the dependability rewards arrange. This will all be made conceivable using our local token, SME. SME tokens will encourage consistent exchange of reward focuses between vendors inside the Steadfastness System.

ROAD MAPS

► June 2017 Project Conception

► December, 2017 Website Launched

► December, 2017 Whitepaper Released

► 10 th January, 2018 Token Airdrop Begins

► February, 2018 Exchange Listing

► March, 2018 Registering as a Mauritius Entity

► April, 2018 Token Sale

► June, 2018 Obtaining Microfinance and Money Remittance Licenses

► July, 2018 Loyalty Rewards Network Launch

► September, 2018 Release of Digital Banking Platform

► September, 2018 Commencement of the Remittance Service

► February, 2019 Release of our Micropayments Application.

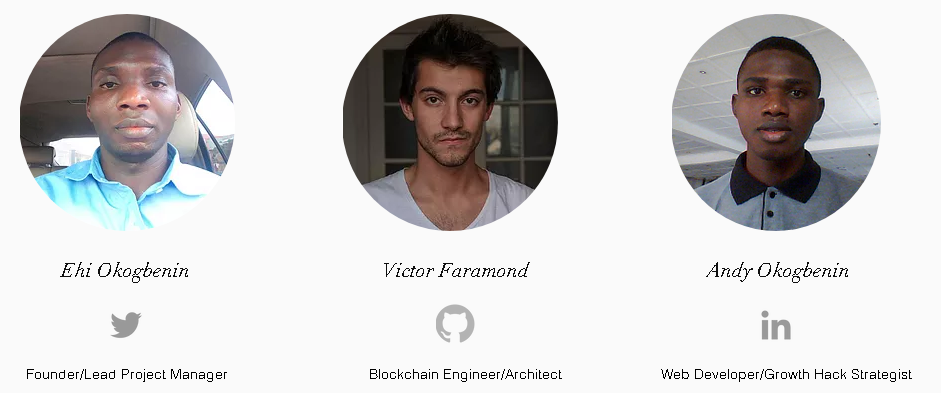

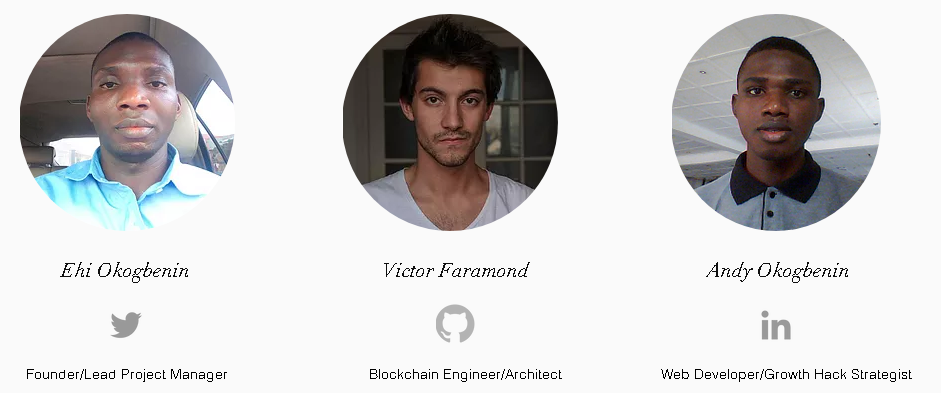

Our TEAM

Ehi Okogbenin : https://twitter.com/ehigbenin7

Victor Faramond : https://github.com/vfaramond

Andy Okogbenin : https://www.linkedin.com/in/andy-okogbenin-7874a1139/

Come Join Us

Visit Our Official Link :

Website : https://www.smeplatform.co/

Telegram : https://t.me/joinchat/DpYnV04roZlXTXHOETDgJw

Facebook : https://facebook.com/smeplatform/

Twitter : https://twitter.com/PlatformSme

Medium : https://medium.com/@info.socialyn/

Reddit : https://www.reddit.com/user/smeplatform/

Author : Hokky Darmawan

My Bitcointalk profile : https://bitcointalk.org/index.php?action=profile;u=1840810

ETH : 0xb616c8392f2d4741765A3e1BE8D9728Be884797a

Komentar

Posting Komentar